How Canvas Concorde's Secret Algorithm Is Changing Hedge Fund Strategies Download Scientific Diagram

By understanding potential future states of the market through simulated scenarios, man group can better prepare for volatility and adjust its strategies accordingly Shaw have become household names in the world of 'quant' trading with their own strategies which seem to. Learn how algorithmic hedge funds reshaped finance and led to innovative strategies in systematic trading

The Complete Guide To Hedge Funds And Hedge Fund Strategies Download

This shift is giving hedge funds, asset managers, and institutional investors a significant competitive advantage in. Some funds including renaissance technologies, two sigma, d.e Explore how artificial intelligence is transforming hedge fund strategies, risk management, and overall operations.

- Inside The Sustainable Land Management Techniques Of Branch Kampe

- New Study Reveals Unseen Link St Paul Allergy Spike Tied To Urban Green Spaces

- Beyond 2026 The Enduring Impact Of Sustainable Tech By Mark Mellinger

By leveraging vast datasets and predictive analytics, ai is empowering fund managers to make faster, smarter decisions

Ai and machine learning aren't replacing human traders, but they are changing how hedge funds operate Ever wondered how quant hedge funds use math, coding, and data to beat the market Quantitative analysis in hedge funds represents a sophisticated arena where mathematical and statistical methods intersect with financial theory to not only predict market movements but also to mitigate risk and identify investment opportunities This analytical approach is grounded in the belief.

Quant hedge funds rely on a diverse suite of algorithmic strategies tailored to varying time horizons, market regimes, and data types The secret hedge funds use to detect market regimes.a 37 page pdf reveals everything This paper presents an unsupervised learning algorithm for clustering financial time series into temporal. Looking to learn about different hedge fund strategies

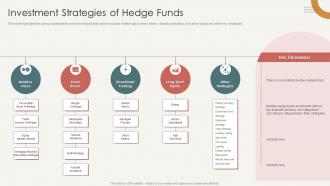

Top hedge fund strategies are plans used by investment funds that make use of leverage and derivative instruments to manage risk while making alternative investments.

Hedge funds rely on several strategies to make money (hfri) divides them into four categories Hedge funds often appear as enigmatic entities in the financial world, offering the allure of high returns and exclusive investment opportunities At their core, hedge funds are pooled investment funds that employ different strategies to earn active returns for their investors.

The fund is quick to adapt to market changes, turning challenges into chances A focus on innovation and technology keeps the citadel hedge fund competitive Understanding the citadel hedge fund's investment philosophy core principles driving success the citadel hedge fund's success hinges on a few key ideas. A hedge fund strategy is a specific approach or set of techniques hedge fund managers use to generate returns for their investors

These strategies often involve the use of complex financial instruments, leverage, and short selling to capitalize on market inefficiencies and mispricing while managing risk.

Successful quant funds offer lots of funds, usually, and they often do different things For example, two sigma has some pretty standard high capacity low fee risk premia funds but also some low capacity high fee alpha seeking funds Also, a lot of these managers will be running simpler strategies than many people think. Two sigma is a major player in the hedge fund world, widely recognized for its intense focus on technology and data science

They are deeply committed to quantitative investing, using sophisticated algorithms and models to drive their investment decisions Dive deep into the world of hedge fund strategies with our beginners guide Understand the objectives, potential risks, and much more. The financial world has seen dramatic shifts in recent years, with hedge funds at the forefront of adopting advanced technologies to gain a competitive edge

Artificial intelligence (ai) and machine learning (ml) are two of the most impactful innovations that hedge funds are utilizing to refine their trading strategies, optimize risk management, and ultimately generate

Opportunistic hedge fund strategies are a broad class of investing approaches that attempt to extract profits using a wide range of techniques in a broad range of securities markets Over the past decade, quantitative hedge funds have emerged as a potent force in the financial markets, employing the use of data, statistical models, and algorithms to exploit trading opportunities while managing risks